Table of Content

There are many reasons why your loan application could be rejected. The most common reason is poor credit history. If you have defaulted on your loan earlier, you are likely to have a low credit score. In this case, your loan application will be rejected by the bank.

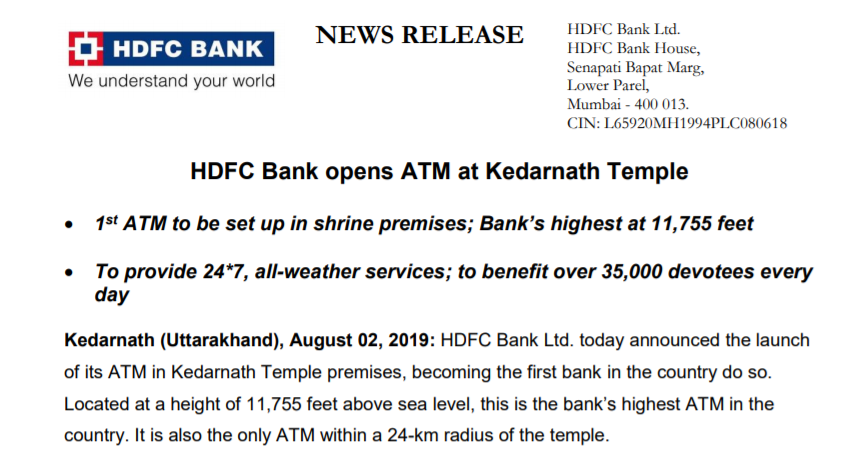

All about HDFC home loan interest certificate.HDFC home loan interest in August 2022.Cheapest home loan interest rate in Check Interest Rates of All Banks.How to check SBI home loan status? You can check the HDFC home loan application offline by visiting the branch or by calling on the customer service number. The monthly EMIs that will be debited from your bank account also increases as the interest rate on your home loan increases. Note that the interest rates are subject to the credit/ risk profile as assessed by HDFC based on certain parameters such as credit scores, segments, repayment of other loans, etc. Choose a home loan provider who offers doorstep assistance or gives you the facility to apply online for a home loan by uploading the required documents from the comfort and safety of your home or office. Go through the list of documents required and keep them ready before starting your home loan application process.

Home Loan FAQs

Check with the lender if the property that you have shortlisted can be funded. Provide all the required legal and technical documents so that the lender can carry out the necessary due diligence. There has been a significant reduction in GST rates on home purchase. We'll ensure you're the very first to know the moment rates change. Till now, I am highly satisfied with the services provided by HDFC.

For Home Extension Loans, the maximum tenure is 20 years or till the age of retirement, whichever is lower. We are unable to show you any offers currently as your current EMIs amount is very high. You can go back and modify your inputs if you wish to recalculate your eligibility. This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster. Loans against property / Home Equity Loan for Business Purpose i.e. Generally co-applicants are close family members.

HDFC LTDHome Loan

The reset can be according to the financial calendar, or they can be unique to each customer, depending on the first date of disbursement. HDFC may at its sole discretion, at any point during the subsistence of the loan agreement, alter the interest rate reset cycle on a prospective basis. You are required to pay 10-25% of the total property cost as ‘own contribution depending upon the loan amount. 75 to 90% of the property cost is what can be availed as a housing loan. In case of construction, home improvement and home extension loans, 75 to 90% of the construction/improvement/extension estimate can be funded.

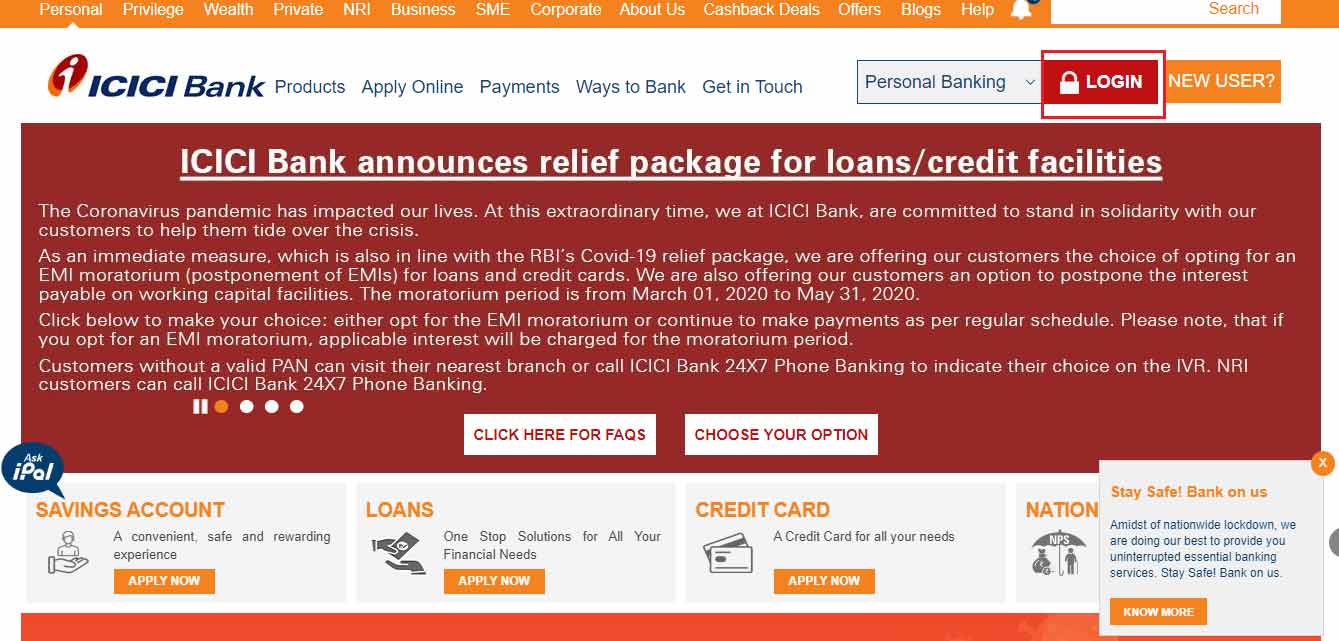

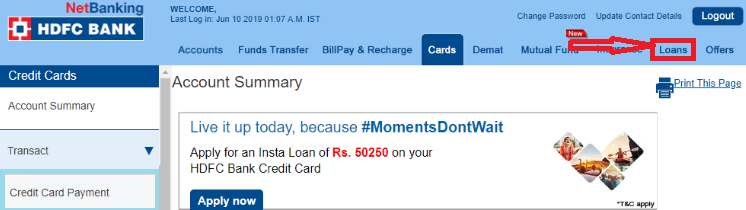

Check your loan eligibility before starting your home loan application. You can also apply online for a HDFC Home Loans by visiting You can even call us on our toll-free number, and our counsellor will visit your home and assist you through the process. You must submit a duly filled application along with important documents such as identity proof, address proof, income proof, etc.

Home Loan Application Process

Fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case. Such fees is payable directly to the concerned advocate / technical valuer for the nature of assistance so rendered. Ensure that the documentation of your home loan application is in order as per the requirement of the lender. If the property you want to purchase is under construction, we will disburse the sanctioned amount in instalments to the developer based on the progress of construction. Based on our assessment, we will determine your loan eligibility. If you’ve had a long-standing relationship with HDFC Bank and have paid all your past loans with them, you will be eligible for an HDFC Bank pre-approval.

Download the app ‘Loan Assist – HDFC Bank Loans’ either on the Google Play Store for Android phones or on the App Store for iPhones. On the next page, you will see the ‘Track Your Application’ section. Here, there are two fields to enter your User ID and password which would be given to you at the time of application. The status of your home loan application will be displayed on the next page. You can avail two home loans at the same time. However, the approval of your loan depends on your repayment capacity.

You may be eligible for tax benefits on repayment of the principal and interest components of your Home Loan as per sections 80C, 24 and 80EEA of the Income Tax Act, 1961. Since the benefits may vary each year, please do consult your chartered accountant/ tax expert for the latest information. With this option you get a longer repayment tenure of up to 30 years. This means an enhanced loan amount eligibility and smaller EMIs.

Avail our home loan services from the comfort of your home! Visit the HDFC Insta Branch on our Instagram page today. Housing Development Finance Corporation Limited (“HDFC”) & HDFC Sales is not an Investment Advisor and does not provide any investment or financial planning advice.

For your convenience, HDFC offers various modes for repayment of your house loan. You may issue standing instructions to your banker to pay the installments through ECS , opt for direct deduction of monthly installments by your employer or issue post-dated cheques from your salary account. You can apply for a home loan online from the ease and comfort of your home with HDFC’s online application feature. Alternatively, you can share your contact details here for our loan experts to get in touch with you and take your loan application forward. Home loan providers usually charge a processing fee around 0.5% of the loan amount to be availed.

Loan amount– This is the amount you want to borrow to fulfil your home needs. Home loan amount mainly depends on value of the property for which the loan is availed. Once logged in, you can view your active applications on the Fincity dashboard.

No comments:

Post a Comment